Porcupine Real Estate Blog

All You Ever Wanted to Know about Appraisals – Buyer Edition

While you might have a long list of things you appreciate about your new home, your lender may not agree. They don't care if it has a pizza oven, jacuzzi tub, or patio that is perfect for outdoor gatherings. They do care if the home you are buying is worth what you're paying.

If there is ever a point where you can't make the mortgage payments, the lender needs to know that they can foreclose on the property and recoup their costs. Because of this, a home must be appraised at or above the agreed-upon purchase price.

Enter the home appraiser.

A Home Appraiser Is Neutral

After you're under contract to buy a home, but before the lender approves the loan so you can close and move in, your lender will likely require the home to have an appraisal.

The appraiser is unbiased and their job is to give an objective opinion of how much the home is worth. They don't represent the buyer or seller; rather, they are contracted by the lender.

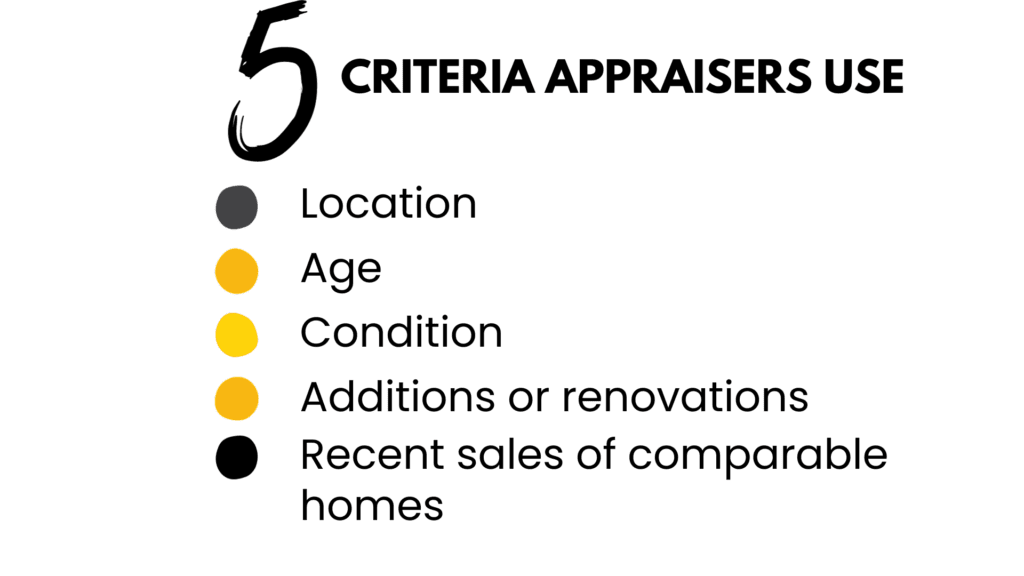

Appraisers survey a house in person, using five main criteria to determine the value of a home:

- Location

- Age

- Condition

- Additions or renovations

- Recent sales of comparable homes

Lenders rely on the sales comparison approach that finds the most recent sales of similar properties.

According to appraiser Sean Brennan, "This can be a very simple analysis, if, for example, the home being appraised is a condo or a cookie-cutter style home in an urban or suburban location where there are many very similar homes selling within the same subdivision. On the other hand, the analysis can be very complex and somewhat subjective if, for example, it's a large, high-end home on large acreage in a rural location. In this instance, comparable sales may be several months old and perhaps 20 miles away. After the best comparable sales are selected, they are adjusted upward or downward for various characteristics (market conditions, lot size, living area, condition, bedroom/bathroom count, etc.) in order to arrive at an indication of value for the property being appraised."

The Buyer Pays for the Appraisal

The home buyer is responsible for paying for the appraisal — and the fee is typically wrapped into your closing costs. Costs vary, but you can expect to pay $400-500 for an appraisal for a single-family home.

Appraisals Take Time

It can take a week or two for an appraiser to get out to the house and write a report. We generally recommend that your lender order the appraisal as soon as you are under contract so that there is plenty of time for the appraiser to go out to see the property and create and submit the report to the lender. This keeps the process moving smoothly and ensures you can close on time, barring other circumstances.

The Appraisal Report

When the appraisal is complete, the appraiser issues a written report to the lender with their opinion of the value of the property.

To produce the report, they use their analysis of the property and data from comparable homes. The report will outline their methodology and may also include photographs that they’ve taken of the property.

You and your lender will both receive a copy of the report. Here's what could happen next:

- If the appraiser’s valuation matches the price you and the seller agreed to for the home: Your lender will proceed to underwrite the loan. This is the final step in your loan approval process!

- If the appraiser’s valuation is higher than what you’re paying for the home: Congratulations! You’ve gained immediate equity, at least on paper. Let’s say, for example, you’re paying $250,000 for the house. If the appraiser says it’s worth $259,000 — score! That’s an instant $9,000 in equity. This is rare but does occasionally happen.

- If the appraisal is lower than what you’ve agreed to pay for the home: Your lender won’t give you a loan for more than the appraised value. If you and the seller agreed on $300,000, for example, but the appraisal comes in at $290,000, that creates a $10,000 shortfall. If you're faced with a shortfall, there are still ways to make the deal work.

What to Do if an Appraisal is Low

Before we talk strategy, some reasons why appraisals come in lower than expected:

- The seller and buyer overestimated the value of the home or features, such as a pool.

- The appraiser isn’t familiar with the neighborhood or town.

- The appraiser had trouble finding comparable sales or missed appropriately comparable homes, so they compared your home with properties outside the area that weren't good matches.

- Home prices in the area are changing so fast that the listing price no longer reflects the market.

If the appraisal comes in low, your agent will offer recommendations about how to proceed. In general, your best strategy is to persuade the seller to lower the selling price, or to split the difference between the home’s appraised value and the original selling price with you. This is when you can rely on your agent's counsel — and their negotiating skills.

Alternatively, you can come up with the cash yourself to cover the difference between the contracted price and the appraised value.

A last resort, according to Brennan, is to persuade the appraiser that he or she made a mistake or missed some information, "In this situation, the buyer likely has the best shot at communicating with the appraiser since they are the client of the bank. The buyer (perhaps with the assistance of the buyer’s agent or the listing agent) will need to prove that the appraiser either missed a comparable sale that is more appropriate or that the appraiser used a sale that is inappropriate. If you can find a sale that is more similar to the property being appraised in terms of proximity, lot size, square footage, year built, condition/quality, etc., then you may be able to persuade the appraiser to use the new data. Also, check to see if the appraiser considered active listings and pending sales." This is a long shot, though, as it can be difficult to get the appraiser to change the value if they did their job properly.

If mutual agreement cannot be reached, the purchase and sales contract may give you the ability to walk away from the deal without penalty, and with your earnest money deposit refunded. This is the case with FHA and VA loans, but not necessarily with conventional loans.

Have more questions on appraisals and the home buying process? Contact us.