Porcupine Real Estate Blog

Helpful Tips for First Time Buyers [It’s not just about your credit score]

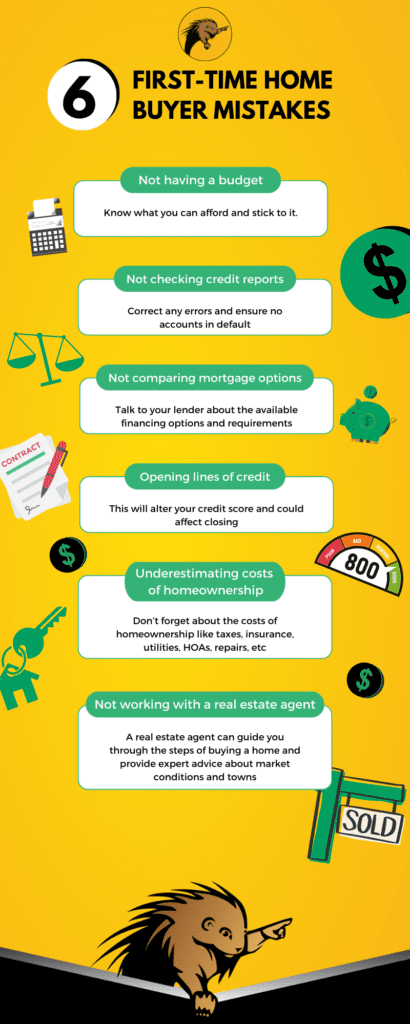

Whatever stage of life you're buying your home at, it is a major milestone. For that reason, it is important to safeguard yourself so you know that you are getting a home and a mortgage that you can afford.

Here are a few tips from mortgage and real estate pros to help prepare you for the biggest purchase of your life:

Check your credit score. Then check it again.

The higher your credit score, the better the interest rate on your mortgage. Make sure you pull your free credit reports from all three agencies, check to make sure that there are no errors or past-due accounts, and have a good understanding of what your score is and how you can improve it.

Some proactive ways you can improve or maintain your credit score are to pay your bills on-time, keep credit card balances low, keep your current cards open, and don't open any new lines of credit.

Start saving early.

Not only will you need money for the down payment and closing costs, it's also a smart idea to have a cushion for recurring and unexpected expenses.

How much do you have to put down?

It depends on what type of loan you have. If you have a conventional loan then you may have to put as much as 20% down, but you can put less down if you don't mind paying mortgage insurance.

If you go with an FHA loan, you will need at least 3.5 % down. USDA and VA loans both have 0% down options.

Alternatives for first-time buyers.

Saving for your first home can sometimes seem like an insurmountable task, but there are assistance programs that can help. The Federal Housing Administration offers loans to people with a credit score as low as 640, low down payments, and down payment assistance.

There are also VA and USDA loans where certain active members of the military and veterans as well as qualifying residents of designated rural areas can qualify for a 0% down-payment housing loans that are free of mortgage insurance fees.

Get pre-approved.

While it can be tempting to skip this step and start looking at houses right away, it's a good idea to get pre-approved for a mortgage before you start your house hunt.

Any mortgage lender can pre-approve you for a mortgage and tell you how much home you can afford based on your financial information. It's a good idea to have this letter in place before you start your search because once you find that perfect property, the pre-approval letter makes for a stronger offer since the seller knows that you can afford the house.

Find a loan that works for you.

There are many different types of loans that you can use to buy a home, from adjustable-rate mortgages to 30-year fixed-rate mortgages. Some state and county maximum loan amount restrictions may apply, but your lender can walk you through all the options available to you.

Hire an agent

An experienced real estate agent who knows the area you’re looking to buy in is invaluable. They can let you know about current market conditions, if homes are priced competitively, and walk you through the buying process.

Not to mention, an agent should be skilled at negotiating and can advocate for what you want.

Finding the perfect home.

Remember, location, location, location. This is one of the most important factors when buying a house because it plays a big part in determining the market value of the home.

Before you start the house-hunting process, make sure you know what neighborhood is a good fit for you. If you're unsure of where to start your search, a good real estate agent can help you narrow down the towns that fit your needs best.

Real estate moves quickly, so if you see a property that you love, you should move on it before someone else does.

The bottom line.

Buying a home can feel like navigating a ship during a storm. But having a team of real estate professionals to answer your questions and help you navigate the process will make it less daunting.

Perhaps most importantly: be patient. There are a lot of steps in the home-buying process and there can be a lot of hurry up and wait. The more experienced your team is and the more organized and educated you are, the easier it will be.