Porcupine Real Estate Blog

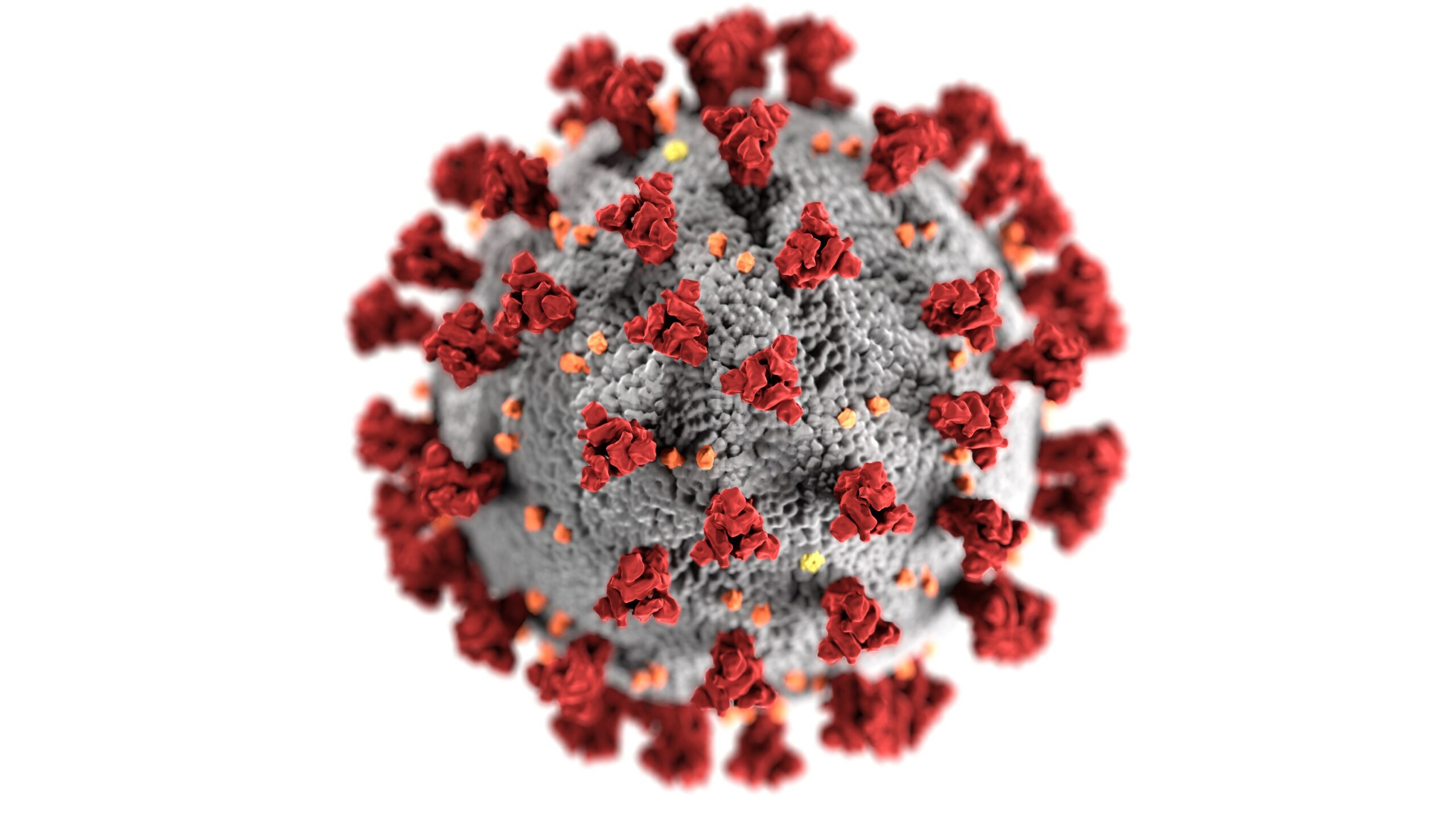

Real Estate During a Pandemic: How Long Will It Take to Buy and Sell a Home Amidst Coronavirus

Buying and selling a home can be a challenge during non-pandemic times: will it pass inspection, can the buyer secure financing, will the home appraise at value? All of these elements can lead to stress and uncertainty. Buying and selling during a pandemic, however, is an entirely different story.

COVID-19 has thrown real estate transactions for a loop. To see just what’s happening in the industry, we had some experts weigh in on the process.

Home Inspections

This process hasn’t changed much since the start of the pandemic. Many inspectors are limiting the number of people present or not allowing anyone else to be present at the inspection. Dustin Dodge of Working Dog Home Inspections recommends that clients don’t attend inspections and, instead, he reviews the report with them in detail after the inspection is complete. “I set aside time to discuss the report and photos in detail with the client after the inspection.”

In addition, Dodge works to keep everyone, including himself, safe by wearing N95 masks and gloves during the entire inspection, keeping proper distance from others, and even having a handwashing station at his vehicle for anyone to use.

There are other trends emerging during the pandemic, too. According to Dodge, some inspectors are wearing body cameras: “It limits liability since other people often aren’t present during inspections now.”

Financing and Appraisals

Like inspectors, mortgage lenders are adapting to a new normal as well. Liz Going* at HarborOne Mortgage hasn’t noticed the closing timeline being drawn out but has experienced some snags with verifying employment. “During the loan process, we sometimes have to have written verifications of employment, and then call the employer 2-5 days before closing to verify nothing has changed. With many people working remotely now, calling the employer’s office number sometimes doesn’t allow us to speak to a Human Resources professional since they are working at home. Having that information for your lender upfront will help to streamline that part of the process.”

Furthermore, home appraisals - where an appraiser visits the house to assess its value and which are required by lenders for any buyer who needs a mortgage - are also being impacted. According to Going, “We have seen adjustments and leniency in guidelines as a result of COVID that have started allowing us to sometimes have exterior-only appraisals and desk reviews done based on data in the MLS. This has helped tremendously as these types of appraisals don’t require the appraiser to visit the actual property or go inside, and they can be done quicker.” Going recommends asking your lender if your particular loan is eligible for this kind of appraisal, and what their protocols are.

Perhaps most importantly, Going recommends staying in close contact with your lender. “To keep things going smoothly, you should definitely let them know if anything changes throughout the process and what concerns you might have.”

*Liz’s opinions don’t reflect those of HarborOne Mortgage LLC, its employees, or affiliates.

Walk-throughs

Pre-closing final inspections are also being affected by the pandemic. Porcupine Real Estate’s agents offer virtual walk-throughs so clients don’t have to unnecessarily put themselves at risk. Mark Warden, owner, and broker at Porcupine Real Estate, says that offering this technology was easy to adopt. “Many of our buyers are from out of state, and others have schedules that don’t allow time for a walk-through. Offering the additional service of a virtual walk-through just makes sense.”

Closings

Home closings can now be done remotely under strict guidelines set by the New Hampshire governor. According to J.L. Sweeney of Sweeney Title Services, technology like Zoom and FaceTime are just some of the tools they are using and there are some modifications they have had to make along the way. “Among other requirements, the notarization must be recorded and if you do not have personal knowledge of the person signing, you must either have a third party present who does know the person or they must present two forms of identification. There are a variety of third-party platforms we use to assist in the verification process.”

For those who do close in person, Sweeney is asking all parties to stay six feet apart. In addition, “Some are closing using different rooms, sometimes the clients are staying in their vehicles or in their homes and we are notarizing from a distance. Most are wearing masks and gloves. We also provide new, unused pens to all parties prior to signing. We also suggest that only the Borrower or the Borrower and Seller appear at closing to limit the number of people in attendance.”

Despite all of these changes to the industry, the real estate market remains strong. As Sweeney confirms, “(R)ates are still low. It is still a great time to buy and even with this pandemic ongoing, there are safe methods with which to purchase or refinance your home. Most closing companies will do whatever it takes to accommodate the needs and concerns of the clients.”