Porcupine Real Estate Blog

Want to avoid the intrusive paperwork when buying an investment property?

If you’ve ever bought a house, chances are you used traditional mortgage financing, like FHA, VA, USDA, or conventional loans. These types of loans are great for the typical buyer.

But if you’re self-employed, have low cash reserves, or just don’t want to deal with a lot of intrusive paperwork, these traditional financing options may not always be the best or the most accessible choice for financing investment properties. Fortunately, there are several alternative financing options that can help investors secure funding for their real estate investments.

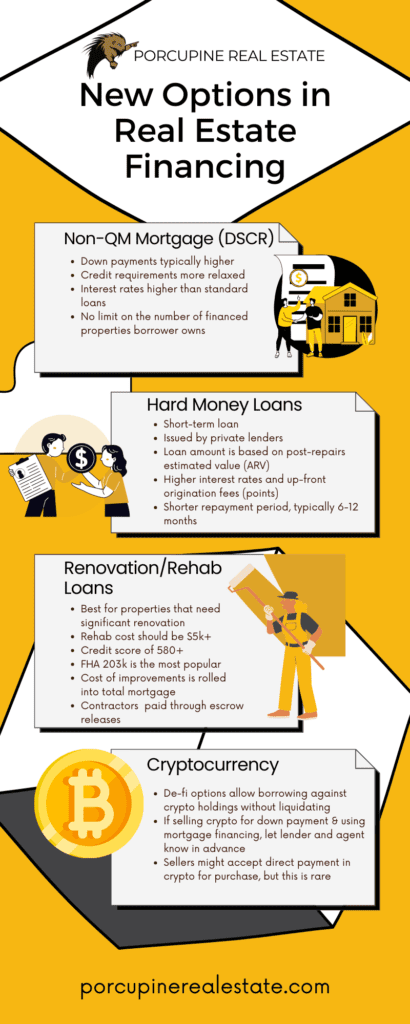

Non-QM (DSCR) Financing

Non-qualified loans (also referred to as DSCR) are designed to help home buyers who can’t meet the strict criteria of a conforming mortgage. This type of loan is especially beneficial for buyers who are self-employed or run their own businesses, and those who work non-traditional jobs.

Non-QM lending guidelines follow regulatory guidelines and also consider a borrower’s ability to repay through cash or business accounts as well as through income generated by the property from rents.

VA Financing

VA loans are a more traditional form of financing and can be used by US military Veterans to purchase small multifamily properties with 2-4 units. But you’d have to live in one of the units for it to count as your primary residence. In some cases, you can use the existing or projected income from the multi-family property to help meet income requirements that the lender has established.

For example, if a 3-unit property rents for $1,000 per month per unit, the income for the property would be $2,000/mo since you have to live in one of the units. The annual income is $24,000, and the lender might count up to 75% of this towards your income. There can be other requirements, too, like having 6 months of cash on hand to pay for the mortgage and any expenses.

Hard Money

Some investors who buy properties that need rehab turn to hard money loans. Often, conventional loans won’t cover properties in rough shape, so getting a hard money loan and then refinancing with a conventional loan or flipping the property after the renovations are complete is a good option.

The issue with hard money loans, though, is that interest rates are higher (in the 10-11% range) and 2-5 points (a point = 1% of the loan value)points are payable upfront and there’s a balloon payment at the end, according to Chris Nadeau, a Senior Loan Officer with Lakeview Mortgage. Hard money is for shorter-term loans that are typically repaid in 6 to 12 months.

Self-Directed IRA

Another non-traditional way to purchase property is to buy an investment property inside your self-directed IRA. This is a solid option for people whose cash is tied up in the stock market, and for those who want to diversify their portfolio. It’s easiest for the IRA to buy the property for cash, otherwise getting a mortgage through the IRA can get messy from a tax standpoint.

The downside here is that there are some limitations and restrictions, like that you can’t take a portion of rents for personal use. All rental income needs to go back into the IRA for future distribution. Additionally, you’ll need to hire a property manager and you’ll have to hire contractors to do any work on the property so this can be an arm’s length transaction. The good news is that repairs and improvements can be paid from the IRA.

Cryptocurrency

A relatively new way to buy an investment property is through a secured loan that lets you borrow cash using your crypto as collateral. These types of transactions usually require borrowers to deposit crypto as collateral to get the loan.

[Not sure how crypto works? We have a Crypto 101 and Crypto 202 series on our YouTube channel]

The process for getting a crypto-backed loan is pretty straightforward and doesn’t require all of the invasive paperwork that traditional lending does. The risk with borrowing against your crypto is that if the crypto’s value falls, you risk your holdings being liquidated. For this reason, it’s a good idea to not borrow a large percentage of your crypto holdings. This sector in De-fi is evolving rapidly and many lenders in the industry have folded, so caveat emptor.

If you don’t want to borrow against your holdings, you can also sell your crypto for the down payment on an investment property, then finance the rest with a traditional lender. The downside to this is that you’ll have to provide the lender with statements showing when/where the crypto was acquired and liquidated. Going this route can be tricky, so it’s best to talk with one of our experienced agents or recommended lenders.

Construction Financing & Rehab Loans

These loans can be good for certain situations, according to Nadeau. The drawback, he warns, is that much more work is involved for you.

Construction financing is used to purchase land and then build your home or for a substantial renovation project. With this type of loan, you’ll have to coordinate with the builder and make sure they fill out all of the paperwork. Plus, you’ll need a qualified general contractor and you’ll have to make sure you have 5% left over in reserves.

Rehab/Renovation loans can add a lot of work for you: you have to get the contractors to the property, then get an itemized estimate that includes labor and materials. There’s also a good chance you’ll have slightly higher interest rates and fees. If you do find your dream home and it’s not in the condition it needs to be in to get financing, you can start with a rehab loan and then refinance when interest rates come down.

Seller Financing

In the current fast-paced real estate market, seller financing is rarely seen. Lenders are eager to provide financing and there are enough buyers out there with traditional financing to make this a less popular option. Occasionally we’ll see this type of financing if a property has been on the market for a long time, if there’s a willing buyer who can’t get the financing due to credit issues, or if the property itself needs repair or rehab.

For example, if a seller has a rundown multi-family that won’t qualify for any type of financing, seller financing would be a good option. Likewise, if a buyer is self-employed and has some cash but can’t get traditional financing and a seller owns their property outright, the seller might structure a deal where the buyer pays a 10-20% down payment and the seller acts as the bank. Usually, these types of loans are only good for the short term (no more than 5 years) and have higher interest rates than a traditional mortgage would.

Want even more information?

While this isn’t an exhaustive list, it’s a good start for finding a new way to fund your real estate investment property. It’s important to keep in mind that not every option is appropriate for every person and that a good real estate transaction isn’t just about price but also the terms. If the price and terms work for both parties, then it’s win/win.

And if you’d like even more information, you can check out our webinar on alternative financing options on YouTube.